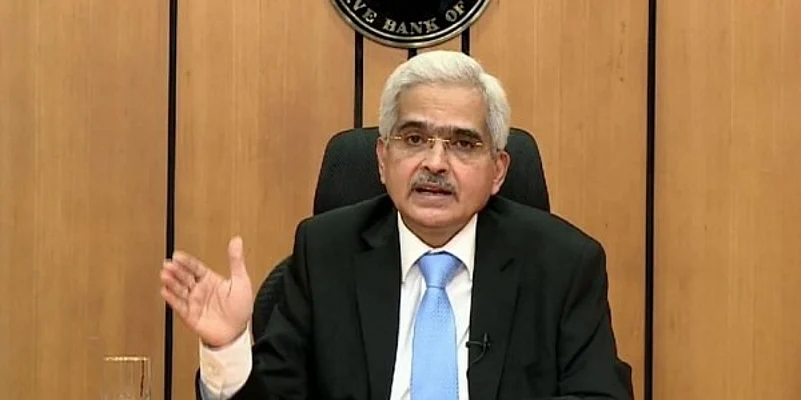

With the Reserve Bank of India (RBI) governor Shaktikanta Das keeping the repo and reverse repo rates unchanged, borrowers heaved a sigh of relief, though depositors may have to make do with lower deposit rates. However, inflation worries continue among consumers for now, though experts say that it would be a positive for the economy the long run. ?

RBI Monetary Policy : Borrowers Heave A Sigh Of Relief, Inflation Worries Continue

With no change in repo and reverse repo rates, borrowers will continue to repay loans with low interest rates. Inflation worries seem to continue among consumers, but it might have a positive impact on the economy in long term.

The repo rate is the interest rate RBI charges when they lend to commercial banks, while reverse repo is the rate at which the central bank takes money from commercial banks.?

This is the ninth consecutive time that RBI has maintained status quo amid the current uncertainties, given the threat of Omicron, the new Covid variant. RBI last changed the rates in December 2020. Since then, the repo rate has been kept unchanged at 4 per cent and reverse repo at 3.35 per cent.?

Borrowers Relieved?

In the wake of pay cuts and job losses over the past year, borrowers were fearing another hit in terms of increased equated monthly instalments (EMIs).?“I am relieved that my home loan EMIs will remain the same, because higher prices of things and a high loan outgo would have been very difficult to manage. Already, with unemployment uncertainty, urban families are under a lot of stress," says Amrita Deka Verma, 43, a professional based and working in Noida.?

Experts agree that this is a boost to affordability. “The unchanged repo rates will help maintain status quo on the prevailing low interest rate regime for some more time. This works well for all home loan borrowers as the environment of affordability will continue,” says Anuj Puri, chairman, ANAROCK Group, in a statement issued on the monetary policy.?

No Incentive For Depositors, Including Pensioners?

With the policy rates remaining the same, interest rates of fixed and other deposits may continue to remain low, even though a few banks raised interest rates recently. ?

Low interest rates eat into the real returns (interest rates minus the inflation rate and taxes) from fixed deposits (read more here).?

But there won’t be any impact on savings overall, assured experts. “Savings will remain unaffected, which is exactly what the current conditions require,” says Raj Khosla, founder and managing director, My Money Mantra, a phygital financial services firm. ?

There seems to be a growing concern among various investors. “The policy appears to be falling behind the curve. But it is good for short-end bonds and mutual fund schemes like short term bond funds and roll down funds with current maturity lower than three years," says Sandeep Bagla, CEO, Trust Mutual Fund, a financial firm. ??

Inflation Worries Continue?

“The stance (on inflation) remains accommodative as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of Covid-19 on the economy, while ensuring that the inflation remains within the target going forward,” said Das during the briefing. ?

RBI clarified in its release that the persistence of high core inflation (CPI inflation, excluding food and fuel) since June 2020 is an area of concern in view of input cost pressures that could rapidly be transmitted to retail inflation as demand strengthens. In this context, the reduction of excise duty and VAT on petrol and diesel will bring about a durable reduction in inflation by way of direct as well as indirect effects operating through fuel and transportation costs.?

Though central banks, typically, raise repo rates to tame inflation. In the past year or so, inflation continued to rise even when RBI reduced the repo rates. “Given the multifarious pulls and pressures on our Covid afflicted economy, an unchanged repo rate is the perfect path. Inflation will of course remain in check. A constant repo rate ensures that the financial system is flush with liquidity, thereby encouraging economic activity,” says Khosla. ?

While consumers are worried about inflation, experts ensure that lower repo rate with a slight rise in inflation may have a positive impact on the overall economy in the long run.? “There is a positive side of inflation, even though it is not good for consumers. But slight rise in inflation means the demand has also gone up. Thus, there is a chance that growing demand will lead to increase in production and supply. With the increase in production, there will be growth in employment and income also. Thus, a small rise in inflation is not bad; rather it is a sign of dynamic economy,” says Dr Sudakshina Gupta, economist and head of the department, Economics, University of Calcutta.? She clarified that a slight rise in inflation is not troublesome, provided the government could handle it properly and ensure steady GDP growth as Covid impacted GDP badly. ??